Embark on a journey of understanding and comparison as we delve into the realm of small business health insurance plans. Unravel the complexities and nuances of different plans to make informed decisions for your business.

Exploring the intricacies of coverage options, premiums, deductibles, and more will equip you with the knowledge needed to navigate the world of small business health insurance.

Understand Small Business Health Insurance Plans

Small business health insurance plans are essential for providing healthcare coverage to employees of small businesses. These plans help ensure that employees have access to medical care when needed, without facing high out-of-pocket costs.

Key Components of Small Business Health Insurance Plans

- Health Coverage Options: Small business health insurance plans typically offer a range of coverage options, including medical, dental, and vision benefits.

- Cost-Sharing Arrangements: Employers and employees often share the cost of premiums, deductibles, and copayments.

- Network Providers: Plans may require employees to visit healthcare providers within a specific network to receive the maximum benefits.

- Prescription Drug Coverage: Many plans include coverage for prescription medications, either through copayments or coinsurance.

Importance of Offering Health Insurance in Small Businesses

Providing health insurance to employees in a small business setting is crucial for several reasons:

- Attracting and Retaining Talent: Offering health benefits can help attract skilled employees and retain current staff members.

- Employee Well-Being: Access to healthcare coverage promotes the well-being of employees and their families, leading to a more productive workforce.

- Legal Requirements: Depending on the size of the business, there may be legal requirements to offer health insurance to employees.

Factors to Consider When Comparing Plans

When comparing small business health insurance plans, there are several factors that business owners should take into consideration to ensure they choose the best option for their employees. Let's delve into the key factors that play a crucial role in this decision-making process.

Coverage Options

One of the most important factors to consider when comparing health insurance plans is the coverage options provided. This includes medical services, prescription drugs, mental health services, and preventive care. Make sure to assess whether the plan covers the specific needs of your employees.

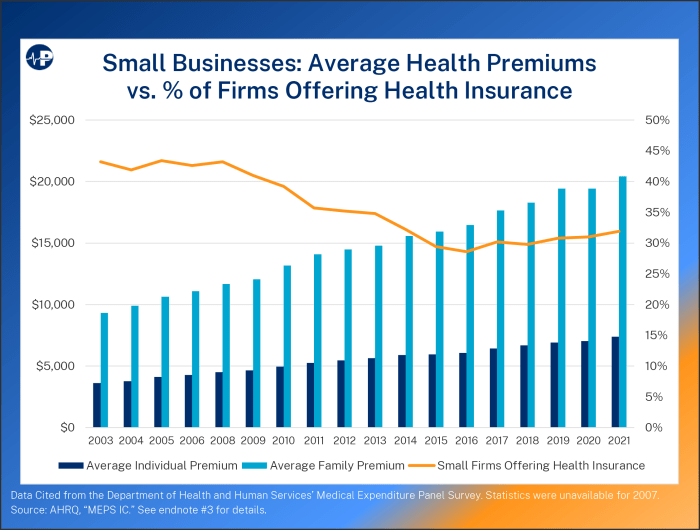

Premiums, Deductibles, and Copayments

Another vital aspect to evaluate is the cost associated with the plan, including premiums, deductibles, and copayments. Premiums are the fixed amount you pay for coverage, while deductibles are the amount you must pay out of pocket before the insurance kicks in.

Copayments are the set amount you pay for specific services. Understanding these costs will help you determine the overall affordability of the plan.

Network Coverage

Network coverage is also a significant factor to consider when comparing health insurance plans. This refers to the doctors, hospitals, and other healthcare providers that are included in the plan's network. It's essential to ensure that your employees have access to a wide network of healthcare providers to receive quality care without incurring additional costs.

Types of Small Business Health Insurance Plans

When it comes to small business health insurance plans, there are several common options available that cater to different needs and preferences. Understanding the differences between these plans can help small business owners make informed decisions that align with their budget and employee requirements.

HMOs (Health Maintenance Organizations)

- HMOs typically offer lower premiums and out-of-pocket costs compared to other plans.

- Employees are required to choose a primary care physician (PCP) who manages their healthcare and referrals to specialists.

- Network restrictions may limit the choice of healthcare providers, but preventive care and wellness programs are often emphasized.

PPOs (Preferred Provider Organizations)

- PPOs provide more flexibility in choosing healthcare providers without requiring referrals from a PCP.

- Although premiums and out-of-pocket costs may be higher than HMOs, employees have the freedom to see specialists without prior approval.

- Out-of-network care is covered at a reduced rate, giving employees more options for healthcare services.

High-Deductible Health Plans (HDHPs)

- HDHPs have lower premiums but higher deductibles compared to HMOs and PPOs.

- Employees must meet the deductible before the insurance plan starts covering costs, making them suitable for those who don't require frequent medical care.

- Health Savings Accounts (HSAs) can be paired with HDHPs to save for medical expenses tax-free.

Each type of health insurance plan has its own set of advantages and limitations, so small business owners should carefully evaluate their workforce's needs and preferences before selecting a plan.

Evaluating Employee Needs

When selecting a health insurance plan for your small business, it is crucial to assess the healthcare needs of your employees. Understanding what your employees require in terms of coverage and benefits can help you choose a plan that best meets their needs and ensures their satisfaction with the provided healthcare options.

Importance of Employee Feedback and Involvement

Employee feedback and involvement are key factors in choosing a suitable health insurance plan for your small business. By actively engaging employees in the decision-making process, you can gain valuable insights into their healthcare preferences and requirements. This not only ensures that the chosen plan aligns with their needs but also increases their satisfaction and engagement with the benefits offered.

- Encourage open communication: Create channels for employees to provide feedback on their current healthcare coverage and suggest improvements or changes they would like to see in a new plan.

- Conduct surveys or focus groups: Gather data through surveys or focus groups to understand employees' priorities when it comes to healthcare benefits and coverage.

- Involve a diverse group: Include employees from different departments or roles in the decision-making process to ensure that the chosen plan caters to the varied needs of your workforce.

Strategies for Aligning Employee Needs with Plan Features

To align employee needs with the features of different health insurance plans, consider the following strategies:

- Customize plan options: Offer a range of plan options with varying coverage levels and benefits to cater to the diverse healthcare needs of your employees.

- Educate employees: Provide clear and detailed information about each plan option, including benefits, costs, and coverage limitations, to help employees make informed decisions.

- Seek input from employee representatives: Engage employee representatives or a benefits committee in the plan selection process to ensure that the chosen options reflect the needs and preferences of the majority.

Last Point

In conclusion, the process of comparing small business health insurance plans is a vital step towards ensuring the well-being of your employees and the sustainability of your business. Armed with this knowledge, you can make confident choices that benefit both your company and your workforce.

Key Questions Answered

What factors should small business owners consider when comparing health insurance plans?

Small business owners should consider coverage options, premiums, deductibles, copayments, and network coverage when comparing health insurance plans.

What are the common types of health insurance plans available to small businesses?

Common types include HMOs, PPOs, and high-deductible health plans (HDHPs).

How can employers align employee needs with different health insurance plans?

Employers can assess employees' healthcare needs, seek feedback, and involve them in the selection process to align their needs with plan features.

![Trulicity Eye Side Effects Lawsuit [2025 Update] | King Law](https://medic.sinergimadura.com/wp-content/uploads/2025/12/Trulicity-Side-Effects-Common-Serious-Long-term-1-120x86.png)